9 Simple Techniques For Health Insurance In Dallas Tx

Wiki Article

The Ultimate Guide To Home Insurance In Dallas Tx

Table of ContentsCommercial Insurance In Dallas Tx for DummiesSome Known Incorrect Statements About Health Insurance In Dallas Tx 6 Simple Techniques For Health Insurance In Dallas TxThe Definitive Guide for Life Insurance In Dallas TxSome Of Health Insurance In Dallas TxThe Ultimate Guide To Insurance Agency In Dallas Tx

And also considering that this protection lasts for your entire life, it can help sustain long-lasting dependents such as children with handicaps. Con: Cost & intricacy an entire life insurance policy plan can be significantly much more pricey than a term life plan for the very same survivor benefit amount. The cash money worth element makes entire life a lot more intricate than term life because of charges, taxes, interest, and also other stipulations.

Bikers: They're optional add-ons you can make use of to customize your policy. Some policies include bikers immediately consisted of, while others can be added at an added expense. Term life insurance policy plans are normally the best remedy for individuals that require inexpensive life insurance policy for a certain duration in their life.

The Insurance Agency In Dallas Tx Ideas

" It's always suggested you consult with an accredited representative to establish the very best remedy for you." Collapse table Now that you're acquainted with the basics, below are added life insurance policy policy types. A lot of these life insurance coverage choices are subtypes of those included over, meant to offer a specific objective.Pro: Time-saving no-medical-exam life insurance policy offers quicker accessibility to life insurance policy without having to take the clinical examination (Insurance agency in Dallas TX). Disadvantage: People that are of old age or have several wellness problems could not be eligible. Best for: Any individual that has couple of health problems Supplemental life insurance policy, likewise recognized as volunteer or voluntary supplemental life insurance, can be used to bridge the protection void left by an employer-paid group policy.

Unlike various other plan kinds, MPI only pays the survivor benefit to your home mortgage lending institution, making it a much a lot more limited alternative than a standard life insurance policy plan. With an MPI policy, the recipient is the home loan company or lender, rather of your household, and also the death benefit decreases over time as you make mortgage settlements, similar to a decreasing term life insurance policy.

The Best Guide To Commercial Insurance In Dallas Tx

Due to the fact that AD&D just pays out under specific scenarios, it's not an appropriate replacement for life insurance policy. AD&D insurance coverage just pays out if you're harmed or killed in an accident, whereas life insurance policy pays for many causes of death. Due to this, AD&D isn't ideal for every person, but it might be useful if you Full Report have a high-risk occupation.

Some Known Details About Health Insurance In Dallas Tx

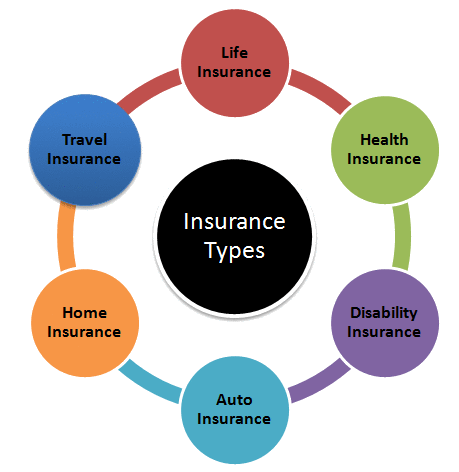

Best for: Couples that do not receive two individual life insurance policy policies, There are two main types of joint life insurance coverage policies: First-to-die: The policy pays out after the initial of the 2 partners passes away. First-to-die is one of the most comparable to an individual life insurance policy policy. It assists the surviving insurance holder cover costs after the loss of monetary assistance.They'll be able to help you contrast life insurance service providers quickly and also easily, as well as find the ideal life insurance policy firm for your circumstances. What are the 2 primary sorts of life insurance policy? Term and permanent are the 2 primary kinds of life insurance policy. The main distinction in between both is that term life insurance policy policies have an expiry date, providing coverage between 10 and also 40 years, as well as long-term plans never run out.

over here Both its duration as well as money value make permanent life insurance coverage lot of times a lot more costly than term. What is the least expensive type of life insurance? Term life insurance is typically one of the most budget friendly and extensive kind of life insurance coverage due to the fact that it's simple and supplies financial defense throughout your income-earning years. How much you spend for life insurance policy, nonetheless, will certainly depend on your age, sex, way of living, as well as health.

How Life Insurance In Dallas Tx can Save You Time, Stress, and Money.

Entire, global, indexed universal, variable, and interment insurance policy are all types of long-term life insurance policy. Irreversible life insurance coverage normally comes with a cash value as well as has higher costs.life insurance market in 2022, according to LIMRA, the life insurance research study organization. On the other hand, term life premiums represented 19% of the market share in the same duration (bearing in mind that term life premiums you can look here are more affordable than whole life premiums).

There are 4 standard parts to an insurance agreement: Statement Web page, Insuring Arrangement, Exclusions, Conditions, It is essential to understand that multi-peril policies may have particular exemptions as well as problems for each sort of insurance coverage, such as collision insurance coverage, medical settlement insurance coverage, obligation coverage, and so forth. You will certainly need to make certain that you read the language for the details coverage that relates to your loss.

Getting The Life Insurance In Dallas Tx To Work

g. $25,000, $50,000, and so on). This is a summary of the significant promises of the insurer and mentions what is covered. In the Insuring Contract, the insurer concurs to do specific things such as paying losses for protected risks, providing certain solutions, or accepting safeguard the guaranteed in a responsibility legal action.Instances of omitted home under a property owners plan are personal effects such as a vehicle, an animal, or an airplane. Problems are arrangements placed in the plan that certify or put limitations on the insurance provider's debenture or perform. If the plan problems are not satisfied, the insurance company can deny the insurance claim.

Report this wiki page